“ID.IFRS" - solution for management accounting

“ID.IFRS” information solution is intended for automation of management accounting of companies (holdings) from any areas of business and consolidation in accordance with the IFRS financial standards. The solution is implemented on the basis of 1C: Enterprise, which will allow to use all the advantages of this platform: accessibility, scalability, ergonomy.

The essential condition for the companies trying to attract foreign investment is preparation of IFRS reports. It is extremely important not just to obtain the reports, but rather make these reports an effective tool for analysis and support in taking management decisions.

Building the IFRS accounting model in the Company contains several stages:

-

Developing the accounting policy of the Company. The accounting policy regulates all aspects of the technology of preparation of financial statements: the main components of the reports, choice of the reporting currency, description of the transformation technology from fully functional currencies (if they are used) into the reporting currency, requirements to preparation of forms of group reporting for the Group members, etc.

-

Developing the Regulations on gathering and processing of information. This document assigns distribution of duties and the corporate regulations on gathering and processing of information during preparation and drawing up of statements.

-

Choosing, setting up and implementing the tools for preparation of financial statements. At this stage, the Company has to establish which tools it will be using for preparation of the financial statements on time and with the required level of detail.

IDelync experts, using their own experience in preparation of financial statements as the basis, as well as their excellent knowledge of our clients’ requirements to these statements, have developed an automated solution for maintaining IFRS accounting and preparation of statements.

In contrast with the most widely spread model of maintaining the accounting in Excel, this solution gives the opportunity to immediately receive “decoded” information on the items of the statements and “submerge” to each transaction or posting (which is quite often required for analysis of the situation).

Thus, significant saving is achieved by means of completeness and substantiveness, timeliness and consistency of the automatically generated IFRS reports. This means that the specialist of financial service will be able to make analysis more effectively and take timely decisions.

On the whole the solution allows to:

-

Automate processing of a greater amount of operations of the same type at the moment of transformation of RAS data into IFRS accounting (entry mapping), which allows to minimize the labour intensiveness of the IFRS accounting maintenance;

-

Itemize the reporting data before the primary discount transaction, which makes the process of checking the IFRS accounting data and collation of the RAS and IFRS data much easier;

-

Maximally decrease the influence of the human factor onto the final result of transformation of accounting data due to automation and control of preparation of statements;

-

Obtain the required analytical breakdown of the finalized statements.

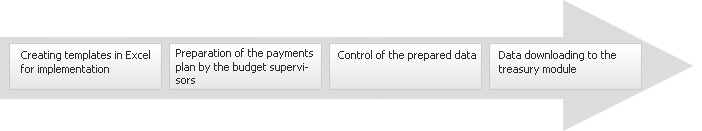

The process of preparation of the consolidated financial statements in accordance with the requirements of the international standards by means of the “IFRS management accounting” solution includes the following stages:

-

Gathering the data of prime records in accordance with the requirements of the Russian legislation and its transformation into IFRS prime records;

-

Necessary alterations and missing primary information are added into the IFRS prime records obtained in the manner described above;

-

The accounting data is consolidated and in the end, the consolidated statements are prepared.

The advantages of this Solution:

-

The solution is implemented on the basis of 1C:Enterprise, which enables use of all the advantages of this platform: accessibility, scalability, open code.

-

Functionality to use different information systems (1C, “Info-Buhgalter”, “Turbo-Buhgalter”, “Parus”) as information systems which are primary information sources.

-

The functional of the system allows to set up accounting in compliance with the IFRS principles regarding “Property, Plant and Equipment”, intangible assets, inventories, which significantly simplifies the procedure of making adjustments (depreciation calculation, asset revaluation, accrual of reserves) with respect to these accounting entities.

-

The flexible system of set up of templates of financial statements and data unload into Excel accounting. There is a dedicated directory of elements of financial statements, in which the statements structure and the information source for each item of the statement are specified. On the basis of the specified structure, an Excel report template is generated automatically and it is further automatically filled in with the Solution data.

-

Roll-out of the values of the reports into consolidation tables is provided for by the mechanism of the Solution, which allows to obtain different management reports on the basis of the consolidation tables.

-

Functionality to single out the intracompany balance and prepare consolidated group statements.

The final solution and the terms of IFRS accounting automation are exclusively individual for each company. IDelync pays special attention to organization of works for preparation of the Company for the implementation, staff recruitment and training. In the course of implementation, operating and management processes in the company, document flow and financial accounting are analyzed, as well as the existing and operating information systems and technologies. The management system, put into the basis of the organization of the project works, intended for development process and implementation of complex systems and Rational Unified Process software, allows to integrate different software into a unified integrated MIS and obtain IFRS statements of adequate quality.

Significant practical experience of IDelync experts in synergy with the theoretical knowledge, allow to find adequate alternative solutions for creating an IFRS accounting system for any one occasion.

Download ID.IFRS presentation >