-

-

- Services

- Arrangement of management accounting and reporting

- Arrangement of bookkeeping and tax accounting

- Budget modeling

- Preparation and consolidation of financial statements in accordance with the international reporting standards (IFRS, US GAAP) and corporate procedures

- Arrangement and optimization of business processes

- Corporate structure optimization

- Analysis of the potential of development of business products and services

- Assessment of investment opportunities of business projects, business plan development, technical and economic assessment

- Financial analysis and modeling

- Due Diligence

- Solutions

- Experience

- Services

-

- Services

- Comprehensive automation of management accounting

- Development and implementation of specialized information systems

- Comprehensive automation of operative accounting

- Automation of tariff calculation and control for public utilities companies

- Arrangement and automation of banking products

- Automation of corporate document flow

- Integration and migration of information systems

- IT projects management

- Gathering and analysis of business requirements to IT solutions

- Assessment and selection of IT solutions

- Development of IT strategy

- Consulting and IT audit

- Telecommunication audit and communications system

- Solutions

- Experience

- Services

-

IT Audit

- Services

- Audit of IFRS financial statements

- RAS audit of financial statements, bookkeeping and taxation

- Consulting services and methodological support

- Outsourcing bookkeeping and tax accounting in compliance with the Russian standards

- Analysis of economic feasibility of expenses included into tariff calculation at public utility companies

- Solutions

- Experience

- HomeIPoint

- Services

-

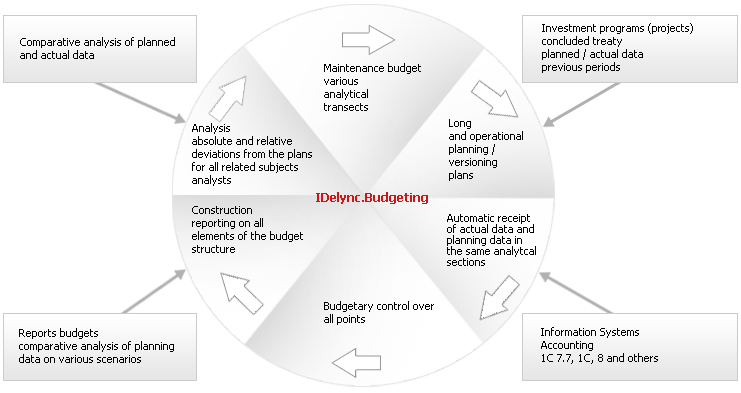

Budgeting solution for any sector “ID.Budgeting”

The “ID.Budgeting” solution is meant for automation of the budgeting process of companies from all sectors. The mechanisms of the solution allow to cover the functions of financial planning and control and provide the financial service of the company (holding) with efficient budgeting tools.

Automation of the budgeting process with the use of the ID.Budgeting MIS ensures performance of the following tasks:

1. Drawing up the master budget of the company consisting of the income and expense budget, cash flow budget, payment schedule (operating plan of execution of the cash flow budget), pro forma balance sheet and other budgets. The drawing up of budgets may be performed in accordance with different scenarios on the basis of the target or actual data for the prior periods.

2. Planning of the monetary funding and controlling the financal condition of the enterprise for any period with a breakdown into turnover of individual items using the necessary analytical breakdowns.

3. Controlling the correspondence of the actual data with the set target indicators.

4. Controlling the correspondence of the current schedule of application of resources with the working schedule for the period and analysis of fulfillment of the budget requests.

5. Drawing up consolidated accounts based on the result of monitoring and multivariate analysis of deviations of the actual data from the target indicators.

Additional features of the “ID.Budgeting” MIS:

Integration of the data from the financial accounting information system with the MIS – the actual data of the budgetary accounting is integrated from the financial accounting information systems, which allows to avoid repeated information input.

The automated business process of “Change Management” provides feedback between the budget and the supporting primary accounting documents.

The control of execution of the budget can be performed virtually at any point of the business process of the enterprise. Five main points can be singed out, in which the execution of the budget can be checked and immediate actions aimed at prevention of deviations of the actual indicators from the target ones can be taken.

Reporting. Multipurpose settings of the reports allow to prepare any reports with arbitrary analytical breakdowns and with different level of itemization. Moreover, the use of the required analytical breakdowns allows to assess the efficiency of different business lines. The plan-fact analysis can be built for each separate budget or a random list of items. This kind of report can be prepared on the basis of separate analytic objects: Centre of financial responsibility, contractor, etc, which allows to itemize the deviations.

Additional distribution procedures. It is not always possible to determine all the required analytics at the moment of posting of the actual dynamics of an item. Distribution into the preset algorithms is provided for this kind of cases. Distributed data is recorded under a different scenario, which allows to compare the data before and after the distribution.

The cycle of the budgeting process in the IDelync.OfficeIPoint. Budgeting MIS

- Preparation and consolidation of financial statements in accordance with the international reporting standards (IFRS, US GAAP) and corporate procedures

The main purposes of preparation of financial statements in accordance with the requirements of the international standards are the faithful representation of financial information required for decision making, ensuring transparency of the statements, presentation of the results of management of resources entrusted to the company’s management.

There is a number of differences between the principles of accounting accepted in certain Russian and international standards.

For convenience, the existing differences can be divided into two groups:

- The first group of differences can be explained by the fact that some rules do not exist in Russia, for example, those related to business combination, depreciation of assets, financial instruments, etc.;

- The second group of differences can be explained by the fact that the Russian Accounting Standards (RAS) and the IFRS have different rules applicable to identical issues, for example, those related to finance lease, reserves, information disclosure in financial statements, etc.

Due to this, when IFRS financial statements are prepared on the basis of the RAS, it is necessary to perform restating. Restating stands for analysis of financial statements adopted by a Russian enterprise, making amendments required for preparation of a comprehensive financial report of the company, which would in general comply with the international financial reporting standards (IFRS, US GAAP).

The full packet of financial statements includes:

- Statement of financial condition (the Balance sheet);

- Statement of total revenue (complex profit and loss);

- Cashflow statement;

- Statement of changes of shareholder equity;

- Key accounting policies;

- Notes to the financial statements;

In the projects involving restatement of financial statements in compliance with the IFRS requirements, IDelync are guided by the principle of individuality of a Client, taking into account the specifics of Client’s activities, prospects of further development and dynamics of capitalisation of a Client’s company.

As a result, the financial statements prepared in accordance with the requirements of international standards may not only be used as financial statements for attracting additional funding or procedures of the company’s capitalization, but also as an instrument for:

- determining strategic key indicators;

- budgeting (planning) procedures in companies;

- financial analysis of attainability of the fixed indicators and assessment of dynamics of a company’s development;

- the mechanism of control of a company’s value.

Apart from financial statements, IDelync provides services of consolidation of financial statements for a group of companies.

The main purpose of preparing consolidated statements is presentation of activities of a holding or a group of interrelated organizations (mother, daughter and independent) as an activity of a single economic unit. A mother company submits consolidated statements in order to objectively and faithfully demonstrate to the owners what their investments are like, that is control and ownership of net assets of enterprises (IFRS 27).

The services of preparation and consolidation of statements may be completed on Client’s request with the services of development of regulations as well as with audit of international and Russian statements.

- Treasury accounting solution “ID.Treasury”

The “ID.Treasury” solution is intended for automation of the process of management of a company’s monetary funds (treasury). The solution can be used both as an independent system or as a built-in module of the systems of financial accounting on the basis of 1C: Enterprise 8.

The main objectives of the treasury functions automation are:

-

To decrease the labour-output ratio and reduction of the accounting information processing time;

-

To increase reliability of information;

-

To enable integration with different information data sources;

-

To ensure prompt preparation of management reporting;

-

To ensure efficiency and immediacy of control.

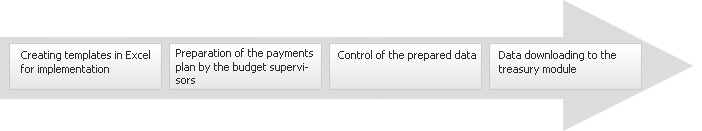

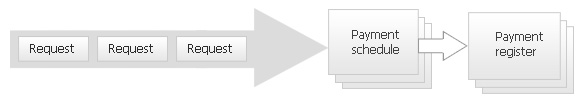

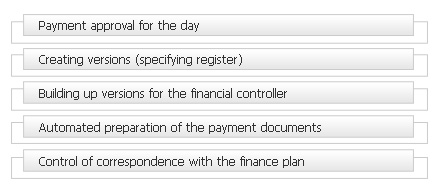

The main functional capabilities of the management information system of the "ID.Treasury":1. Preparation and control of implementation of the financial plan;

2. Functionality to create the payment schedule;

3. Drawing up, analysis and approval of the register of payments;

4. Comparative analysis of the financial plan and the register of payments.The solution includes the following works:

-

Long-term planning of payments – one year, month, week finance plans

Considering the fact that the process of the finance plans preparation involves many services of the company(Centre of Financial Responsibility), the solution allows to prepare finance plan templates in Excel and download them to the treasury module upon the filling of the budget by the supervisors.

-

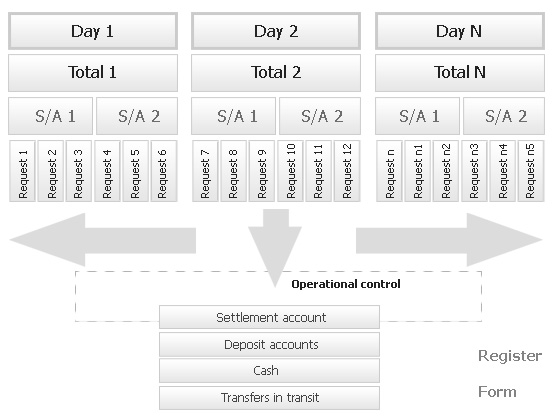

Short-term payments planning – payment schedule, requests for funds application

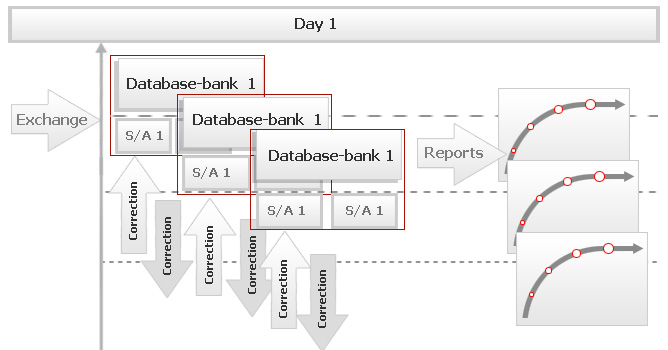

The payment schedule is created in the system by the Treasurer and is an optimal tool for distribution and payments control on the daily basis taking into account the payment schedule and availability of funds. The Treasurer takes the decision regarding the payments for the next several days on the basis of the Payment schedule, indicating which requests for payment will be finalized on which day and from which settlement account. At the same time, this document is the ground for drawing up the Payment Register document. The document has the functional for fast and convenient correction of payments. Moreover, it features the tools necessary for online processing of the document: group processing (for fast changes in properties of several payments at the same time), operating corrections (changes in the reflection of company’s financial situation in the overall balance) and snapshots (records of the financial condition of the company at a particular moment with further reconstruction of the whole picture for analysis of correctness of work of the financial service in general).

-

Storage of the versions of the payment schedule, facilities for their comparison for choosing the best option

The snapshots of the financial condition are intended for saving the interim results of settlement accounts taking into account the payments. The Treasurer, recording the versions, demonstrates the results achieved at the moment of the snapshot. Later, these can be used for analysis of the payments planning process. The reports also allow to choose the snapshots (below referred to as versions) and show the condition of the payments at the moment of the version creation.

-

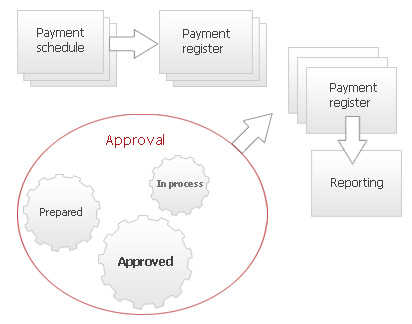

Approval of payments

The approval process takes place upon agreement of all payments. Then the approved payment register is created. The main schedule and registers may have specifying schedules and registers.

The Payment Register is the document to be approved and acts as the final point of payment planning. Upon approval of the document, it is impossible amend the requests for expenditure included into this payment register and payment schedule, on the basis of which the payment register was created.

The payment register contains payments which will be performed on the date of the payment.

-

- “ID.IFRS" - solution for management accounting

“ID.IFRS” information solution is intended for automation of management accounting of companies (holdings) from any areas of business and consolidation in accordance with the IFRS financial standards. The solution is implemented on the basis of 1C: Enterprise, which will allow to use all the advantages of this platform: accessibility, scalability, ergonomy.

The essential condition for the companies trying to attract foreign investment is preparation of IFRS reports. It is extremely important not just to obtain the reports, but rather make these reports an effective tool for analysis and support in taking management decisions.

Building the IFRS accounting model in the Company contains several stages:

-

Developing the accounting policy of the Company. The accounting policy regulates all aspects of the technology of preparation of financial statements: the main components of the reports, choice of the reporting currency, description of the transformation technology from fully functional currencies (if they are used) into the reporting currency, requirements to preparation of forms of group reporting for the Group members, etc.

-

Developing the Regulations on gathering and processing of information. This document assigns distribution of duties and the corporate regulations on gathering and processing of information during preparation and drawing up of statements.

-

Choosing, setting up and implementing the tools for preparation of financial statements. At this stage, the Company has to establish which tools it will be using for preparation of the financial statements on time and with the required level of detail.

IDelync experts, using their own experience in preparation of financial statements as the basis, as well as their excellent knowledge of our clients’ requirements to these statements, have developed an automated solution for maintaining IFRS accounting and preparation of statements.

In contrast with the most widely spread model of maintaining the accounting in Excel, this solution gives the opportunity to immediately receive “decoded” information on the items of the statements and “submerge” to each transaction or posting (which is quite often required for analysis of the situation).

Thus, significant saving is achieved by means of completeness and substantiveness, timeliness and consistency of the automatically generated IFRS reports. This means that the specialist of financial service will be able to make analysis more effectively and take timely decisions.

On the whole the solution allows to:

-

Automate processing of a greater amount of operations of the same type at the moment of transformation of RAS data into IFRS accounting (entry mapping), which allows to minimize the labour intensiveness of the IFRS accounting maintenance;

-

Itemize the reporting data before the primary discount transaction, which makes the process of checking the IFRS accounting data and collation of the RAS and IFRS data much easier;

-

Maximally decrease the influence of the human factor onto the final result of transformation of accounting data due to automation and control of preparation of statements;

-

Obtain the required analytical breakdown of the finalized statements.

The process of preparation of the consolidated financial statements in accordance with the requirements of the international standards by means of the “IFRS management accounting” solution includes the following stages:

-

Gathering the data of prime records in accordance with the requirements of the Russian legislation and its transformation into IFRS prime records;

-

Necessary alterations and missing primary information are added into the IFRS prime records obtained in the manner described above;

-

The accounting data is consolidated and in the end, the consolidated statements are prepared.

The advantages of this Solution:

-

The solution is implemented on the basis of 1C:Enterprise, which enables use of all the advantages of this platform: accessibility, scalability, open code.

-

Functionality to use different information systems (1C, “Info-Buhgalter”, “Turbo-Buhgalter”, “Parus”) as information systems which are primary information sources.

-

The functional of the system allows to set up accounting in compliance with the IFRS principles regarding “Property, Plant and Equipment”, intangible assets, inventories, which significantly simplifies the procedure of making adjustments (depreciation calculation, asset revaluation, accrual of reserves) with respect to these accounting entities.

-

The flexible system of set up of templates of financial statements and data unload into Excel accounting. There is a dedicated directory of elements of financial statements, in which the statements structure and the information source for each item of the statement are specified. On the basis of the specified structure, an Excel report template is generated automatically and it is further automatically filled in with the Solution data.

-

Roll-out of the values of the reports into consolidation tables is provided for by the mechanism of the Solution, which allows to obtain different management reports on the basis of the consolidation tables.

-

Functionality to single out the intracompany balance and prepare consolidated group statements.

The final solution and the terms of IFRS accounting automation are exclusively individual for each company. IDelync pays special attention to organization of works for preparation of the Company for the implementation, staff recruitment and training. In the course of implementation, operating and management processes in the company, document flow and financial accounting are analyzed, as well as the existing and operating information systems and technologies. The management system, put into the basis of the organization of the project works, intended for development process and implementation of complex systems and Rational Unified Process software, allows to integrate different software into a unified integrated MIS and obtain IFRS statements of adequate quality.

Significant practical experience of IDelync experts in synergy with the theoretical knowledge, allow to find adequate alternative solutions for creating an IFRS accounting system for any one occasion.

Download ID.IFRS presentation >

-

- Machine Building

- Development and implementation of an IS for automation of operative accounting and management for MIOL Company, Kharkov, Ukraine

MIOL Company is a producer of hand-held tools (air tools, equipment for service stations, etc.). The Company has a wide dealer network in Ukraine with the head office in Kharkov and it also has representatives in CIS countries.

In the course of significant growth the Company was confronted with difficulties in connection with the efficiency of the operative part of the business processes. It was decided to automate operative accounting and eliminate bottlenecks in the operative processes in the course of implementation of the new system.

On the basis of the preliminary examination by the Consultant, it was suggested that 1C:Enterprise "Trade Management 8" should be used as the basic solution, namely, the following modules: Sales Management, Purchasing Management, Inventory Management, Pricing, Sales and Purchasing Planning, Cash Management, Integration of 1C: Trade Management 8 and 1C: Accounting 7.7, technology of managing distributed databases, Management accounting.

In order to speed up the process of customer order processing at the cost of saved time during acceptance, assembly and shipment of goods, 1C technology was used to build the business processes. For the purposes of comparison, analysis and prompt decision-making in the fast-changing market conditions, storage of the prices of suppliers, own prices and those of competition was organized and implemented. Due to the long production cycle (China) and delivery of goods, a procedure was developed to generate the need and develop sales plans with different planning horizons. Generation of purchasing plans on the basis of sales plans for a period of over 3 months.

In order to ensure work of a number of branches situated in different Ukrainian cities, the Consultant implemented the technology of management of distributed databases and data exchange between the units via email was set up. The Consultant designed and developed the reporting forms for analysis of profit and profitability; analysis of satisfying the needs; analysis of expenses by the item; analysis of the target sales and purchases; analysis of similarity of target data, ABC and XYZ classifications of customers and goods

- Development and implementation of an IS for automation of operative accounting and management for MIOL Company, Kharkov, Ukraine

- Food Industry

- Re-engineering of business processes of procurement and equipment delivery for Tetra Pak Moscow, Russia

Tetra Pak was founded in 1951 and offers modern, high-tech solutions in the field of processing and packaging, food delivery.

The objective of this project was to increase the efficiency of the business process of purchasing and delivery of equipment for the technological solutions offered to the company’s clients. The work included development of supply policy, business process optimization and development of an information system for automation of the business process. In the course of the project, a visual model and description of the business process were developed as well as the key indicators of process efficiency and specifications of the information system were prepared. The project results were further used in development and implementation of a supply management system. This project included development of a system architecture reflecting all business requirements, development of the system and its integration with Scala corporate information system, implementation of control procedures for the supply system and the management accounting pack.

- Re-engineering of business processes of procurement and equipment delivery for Tetra Pak Moscow, Russia

- Wholesale and Retail Trade

- Integrated project for HomeIPoint, Moscow, Russia

HomeIPoint is a project set up by IDelync aimed at creating a safe and comfortable environment for people. Using highly technological products, HomeIPoint specializes in designing, installation and support of solutions of remote control and administration of life support systems of a house, flat or office.

The project included organization and automation of business and tax accounting, recording of working time by the project, budgeting, IFRS-compliant accounting and reporting. Integration of the system of administrative accounting with the company’s website.

- Arranging and automation of the processes of buying commodities and materials, treasury function, AVTOVAZ Automobile Trading Company

Within the framework of the project, IDelync fulfilled the following responsibilities:

- Analysis and arranging of business-processes of buying/selling commodities and materials;

- Conducting of assessment and selection of a solution for automation of management, business and tax accounting;

- Designing of hardware and software IT infrastructure, assisting in selection of suppliers and carrying out of procurement activities;

- Assisting in development, configuration and administration of netware, hardware and software;

- Development and implementation of a subsystem of management of treasury accounting operations.

- Integrated project for HomeIPoint, Moscow, Russia

- Housing and communal Services

- Public-private partnership for Rostov-on-Don water and wastewater utility, Rostov-on-Don City Administration

The overall objective was to improve financial and operational performance of the water services utility in Rostov-on-Don by involving the private sector. The specific objective of the assignment was to assist the Rostov-on-Don City Administration select a private operator to manage and operate the utility. The work involved setting the strategic objectives for the partnership, defining the requirements and selection criteria for a private operator, and managing the procurement process. Potential partners were identified and assessed against the selection criteria, and a preferred bidder chosen to submit a detailed proposal. Branan evaluated the proposal in terms of its strategic concept, social impact, commercial and legal arrangements, management systems and financial model. The evaluation provided the basis for successful contract negotiations.

- Assistance in preparation of IFRS financial statements and audit, Municipal Unitary Enterprise "Upravleniye Gorodskogo Khoziaistva" of the Municipal Entity City Pyt-Yakh

IDelync is currently providing IFRS accounting support to Municipal Unitary Enterprise "Upravleniye Gorodskogo Khoziaistva" of the Municipal Entity City Pyt-Yakh, which is a participant in an EBRD investment project. IDelync is assisting the company in preparation of IFRS financial statements, carries out annual audit of the IFRS consolidated financial statements and provide advice on improvements in financial management procedures required to implement recommendations and comments of IFRS annual audit reports.

- Assistance in preparation of IFRS consolidated financial statements and audit, OAO "Yugorskaya Territorial Energy Company"

IDelync is currently providing IFRS accounting support to OAO "Yugorskaya Territorial Energy Company", which is a participant in an EBRD investment project. IDelync is assisting the company in preparation of IFRS consolidated interim financial statements, carries out annual audit of the IFRS consolidated financial statements and provide advice on improvements in financial management procedures required to implement recommendations and comments of IFRS annual audit reports.

- Public-private partnership for Rostov-on-Don water and wastewater utility, Rostov-on-Don City Administration

- Banking

- Optimization of telecommunication expenses for Raiffeisen Bank Aval, Kiev, Ukraine

Raiffeisen Bank Aval is one of the biggest banks of Ukraine with a wide network of branches. It boasts a long list of banking services rendered to the bank’s clients via the nation-wide network, which includes up to 1000 structural departments working in all regions of Ukraine.

In 2007 Raiffeisen International Bank –Holding AG conducted a complex international project aimed at decreasing telecommunications expenses and optimization of the group’s telephony expenses. Implementation of this project as one whole is performed by Devoteam Group, the largest European consulting group.

IDelync’s experts were invited to conduct works under this project in Ukraine to assist in troubleshooting of the current state and preparation of a programme aimed at decreasing communications expenses of all branches of the bank in Ukraine.

Works in the framework of the project:

-

comprehensive data analysis of the condition of the bank's telephony (documents, contractual relations, the architecture of the network, expenses);

-

gathering data on market tariffs of landline and mobile communication in Ukraine; expert analysis of corporate business offers;

-

finding possibilities to decrease tariffs and optimize the communication architecture;

-

preparing recommendations as to reducing communications expenses;

-

developing an applied model of use of the technical solution to utilize additional equipment (GSM-modules) to save communications expenses.

On the basis of the Project the bank was prepared by the Consultant for conducting balanced, purposeful negotiations with the largest national operator of landline communications regarding the tariff policy and discounts. The direction of implementation of alternative technical solutions suggested by the Consultant aimed at optimization of communications expenses was also performed, which allowed to quickly achieve an effective decrease in telephony expenses at the first stage of implementation.

-

- Analysis of the telecommunications structure and communications systems for UkrSibbank Stock Company, BNP Paribas, Kiev, Ukraine

UkrSibbank is one of the most dynamically developing multipurpose banks on the Ukrainian market. The bank is a member of the international BNP Paribas Group, which takes the first place among foreign banks represented in Ukraine in terms of assets, net profit and market capitalization.

The objective of the project is to decrease telecommunications expenses by means of reorganization of telecommunications architecture of the bank network and the telecommunication channels.

The project included troubleshooting of the parameters of the existing network as well as a corresponding assessment of the prospects and possibilities of implementation of a renewed format of multiservice networks with implementation of VOIP telephony and a single service numbering plan. A competitive analysis of tariffs and prospects in Ukrainian market in the field of network communications and routing was performed as well.

Works performed within the framework of the project:

-

comprehensive analysis of the data reflecting the state of operator communications of the bank (documents, contractual relations, the architecture of the network, expenses);

-

data analysis on the internal technical condition of the architecture of the bank, communications equipment and the condition of IP-telephony; analysis of the numeric field of land-line communications in Ukraine;

-

gathering data on tariffs and covering on the market of network communications and routing of Ukraine, expert analysis of corporate business offers;

-

cross-evaluation of market presence of vendor suppliers of machinery as well as integrator companies on the market of network communications and routing;

-

developing suggestions as to changes in the organizational structure and a new informational and technical architecture for purposes of implementation of a multiservice network, a single numbering plan and a service call-centre.

-

- Optimization of telecommunication expenses for Raiffeisen Bank Aval, Kiev, Ukraine

- Furniture

- Development and implementation of a MIS, support and development of the implemented solution for Mebelnyi Kapitan Ltd., Poltava, Ukraine

Mebelnyi Kapitan designs and produces cabinet furniture both to individual orders and in mass production. In 2006 and 2007 the company renewed and purchased additional equipment, which led to a significant increase in qualitative characteristics of the produced product.

The growth of production volumes in Mebelnyi Kapitan in its turn made the issue of achievement of high quality characteristics of each order burning. A Consultant was invited for the purpose of optimization of business processes of operative accounting with its further automation. The Consultant suggested to implement the operative accounting on the basis of 1C:Enterprise 8.

The business processes of raw material purchasing, warehouse logistics, sales and production planning and selling were analyzed and optimized. A MIS on the basis of 1C:Enterprise was implemented to automate the operative accounting in warehouses, at production facilities, of bookkeeping and tax accounting, management accounting. Besides, differentiated access of users of different categories to the MIS information was implemented. On the basis of the MIS data, all units of the client Company receive required reports, including management reports on analysis of financial results of the Company’s activity.

- Development and implementation of a MIS, support and development of the implemented solution for Mebelnyi Kapitan Ltd., Poltava, Ukraine

- Mobile communications and services in telecommunications

- Development and implementation of a billing system and a management accounting system for Communications and Technology Ltd., Poltava, Ukraine

Communications and Technology Ltd. (further referred to as the Company) provides its customers with economically efficient telecommunications solutions by means of using modern technologies of services in the field of utilization of mobile and landline communications as well as IP-TEL.

The objective of the project is to decrease telecommunications expenses by means of reorganization of telecommunications architecture of the bank network and the telecommunication channels.

The project included troubleshooting of the parameters of the existing network as well as a corresponding assessment of the prospects and possibilities of implementation of a renewed format of multiservice networks with implementation of VOIP telephony and a single service numbering plan. A competitive analysis of tariffs and prospects in Ukrainian market in the field of network communications and routing was performed as well.

Works performed within the framework of the project:

-

comprehensive analysis of the data reflecting the state of operator communications of the bank (documents, contractual relations, the architecture of the network, expenses);

-

data analysis on the internal technical condition of the architecture of the bank, communications equipment and the condition of IP-telephony; analysis of the numeric field of land-line communications in Ukraine;

-

gathering data on tariffs and covering on the market of network communications and routing of Ukraine, expert analysis of corporate business offers;

-

cross-evaluation of market presence of vendor suppliers of machinery as well as integrator companies on the market of network communications and routing;

-

developing suggestions as to changes in the organizational structure and a new informational and technical architecture for purposes of implementation of a multiservice network, a single numbering plan and a service call-centre.

-

- Development and implementation of a billing system and a management accounting system for Communications and Technology Ltd., Poltava, Ukraine